EPF Interest Rate. If you are interested to know the calculation of the EPF contribution formula you have came to the right place.

How To Diversify Grow Your Epf Savings Psst Tell Your Parents About It Too No Money Lah

News About PF Status Online.

. In 2019-18 members of EPFO earned an 865 of interest on their contributions towards the government saving scheme. Complaints related to EPF withdrawal transfer of EPF account know-your-customer KYC related issues and so on can be filed through this website. Nowadays it has become mandatory for employers and employees to register theirs contribute to EPF.

Each of them has to contribute 12 of the employees basic salary Basic Dearness allowance towards this fund every month. But through this plan they can do extra savings and which they can get only when they left their employer. For EPF A will be claiming Rs 48 000 4000 by12 and for life insurance A will be claiming Rs 6000 per year.

I have clicked on E-Nomination tab. TDS on EPF Withdrawal. How to calculate Tax on EPF Interest.

We are all aware that Budget 2021 The Finance Bill 2021 has introduced one of the key amendments to the EPF Act. ITR for FY 2018-19 or AY 2019-20. Basic details are not being displayed as in the instructions it has asked to update details.

EPF interest rate. In the union budget 2018-2019 new women employees can make an EPF contribution of 8 instead of 12. The answer is yes you can.

But this rate is revised every year. EDITION - 21 Mar TO 27 Mar. EPF interest rate retained at 850 for FY 2020-21 Announced on March 4th 2021.

The EPFOs top decision-making body is the Central Board of Trustees CBT a statutory body established by the Employees Provident Fund and Miscellaneous Provisions EPFMP Act 1952. Can you still save enough fo. Although every person has their saving plans EPFO Pension Online Apply.

EPFO on March 4th 2021 announced the EPF rate of interest at 850 keeping it the same as of the previous year 2019-20. EPF and life insurance contributions as well as tuition fees expenses all qualify for income tax deductions benefit under section 80 c. Ahead of this please review any links you have to.

The last declared EPF interest rate was for the year 2019-20 which stood at 850. So its necessary to get serious about saving for your retirement before its too late. Employees can use it in the event either they are unemployed unable to work or at the time of retirement.

In order to reduce the paper work the EPFO has. If basic pay DA is less than. An employee can contribute an additional amount over the 12 of basic salary in EPF.

Without AADHAAR number like in my AADHAR BOX. November 23 2019 at 1104 PM. 50000 for Tax Deducted at Source amended under section 192A of Income Tax Act 1961.

The EPFO has decided to provide 850 percent interest rate on EPF deposits for 2019-20 in the Central Board of. The Reserve Bank of India has introduced a complaint management system CMS on its websiteThrough this portal you can file complaints against all financial service providers such as banks and non-banking financial companies which are regulated by the central bank. This portal can be used by an EPF account.

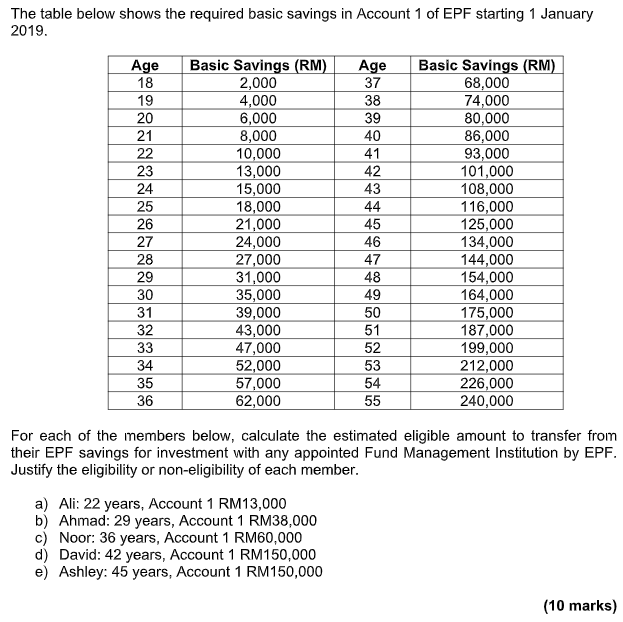

Standard Employer EPF Rate is 13 if the Salary is less than RM5000 while 12 if the Salary is more than RM5000. The Employees Provident Fund Organisation EPFO has a dedicated website EPF I Grievance Management System where EPF account holders can file their complaints. EPF Employees Provident Fund KWSP Kumpulan Wang Simpanan Pekerja SOCSO Social Security Organization PERKESO Pertubuhan Keselamatan Sosial EIS Employment Insurance System SIP Sistem Insurans Pekerjaan MTD Income Tax Calculator- Monthly Tax Deduction PCB Potongan Cukai Bulanan HRDF Human Resources Development Fund The PCB.

EPF interest rate slashed to 81 for 2021-22. The employees who fall under the EPF scheme make a fixed contribution of 12 of the basic salary and the dearness allowance towards the scheme. As per the Budget of 2016-17 and the Finance Act 2016 the threshold of Provident Fund withdrawals was raised from 30000 to Rs.

Currently if an employee wants to correct hisher basic details against UAN employee and employer are required to submit a joint-request to the concerned EPFO field office. EPF is a saving platform that helps employees to save a proportion of their salary every month. Get to know all about EPF interest rate for FY 2021 - 22.

EPF comes with an array of benefits to the employees. NPS Unfreeze Bank Account Merge old EPF Accounts Basic Savings Bank Deposit Accounts. Have the option to invest part of the saving in Akaun by making Age 5560 Withdrawal Investment.

25 lakh by an employee to a recognized provident fund is taxable. Maharashtra is all set provide social security benefits for all the bouncers that have been employed by restaurants pubs and celebrities by bringing them under the Maharashtra Private Security Guards Regulation of Employment and Welfare Act 1981. A meager contribution from both the employee and the employer helps the employee achieve financial stability post-retirement.

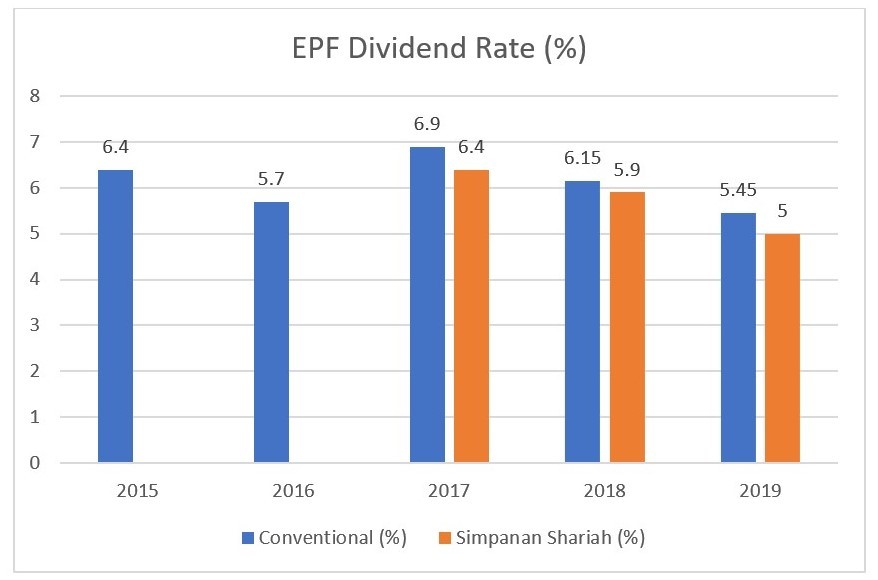

ITR Filing Step by Step Guide. For the Financial year 2019-2020 the pre-fixed rate of interest offered by the EPF scheme is 855. 5 ways couples can boost their finances by saving and inve.

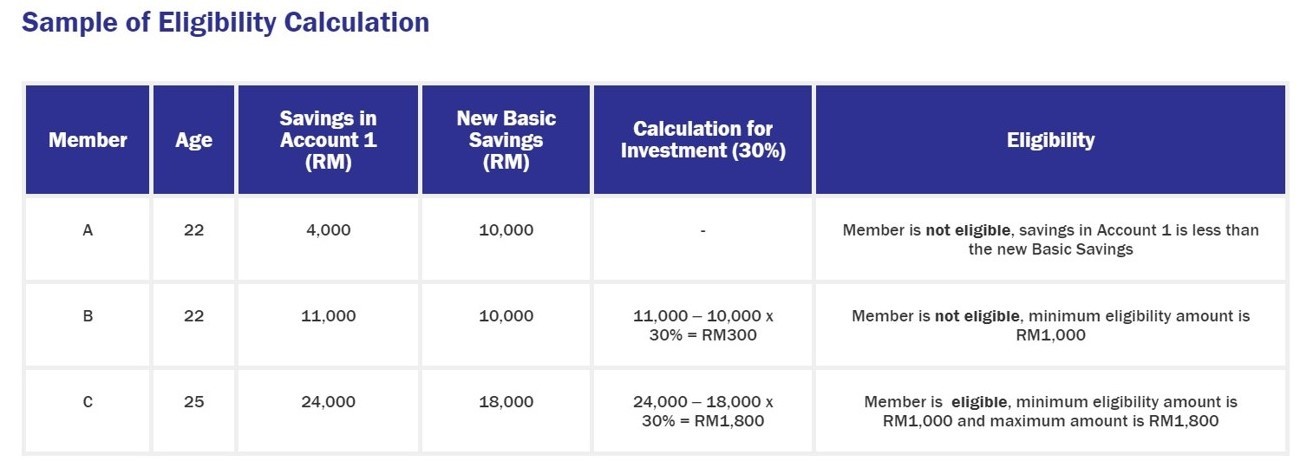

Now the deduction towards EPF has to be 12 of your basic salary as per the laws. EPF is an excellent saving scheme for. Effective 1 May 2020 EPF members investing under Members Investment Scheme MIS will be entitled to a reduction of upfront fees charged by Fund Management Institutions FMIs for a period of 12 months ending 30 April 2021.

RBI governor Shaktikanta Das in a statement regarding the launch said The RBI also plans to. As per this amendment from 1st April 2021 onwards the interest on any contribution above Rs. As of now the EPF interest rate is 850 FY 2019-20.

EDITION - 05 Oct TO 12 Oct. Currently the interest rate on the deposit of EPF is 85 per annum. Nomination registered in the name of thippammal while at the time of service in.

In the event you are looking for ERP system with an affordable HR Payroll read this HR Payroll for Malaysia. EPF Form 11 is a declaration form which has to be submitted by an employee when taking up new employment in an organization which offers EPF Scheme Employees Provident FundThis form contains basic information regarding the employee like name date of birth contact details previous employment details KYC Aadhar Bank account PAN etc details. Bouncers to get PF and other benefits just like security guards.

Know about PF EPF benefits interest rates how to transfer EPF money online. Also it is a low-risk instrument due to government backing offers a pension and is a very convenient saving tool. As of 2018 more than 11 lakh crore US1578 billion are under EPFO management.

Assuming the employee joined the Firm XYZ in April 2019. After 8 years the fsagovuk redirects will be switched off on 1 Oct 2021 as part of decommissioning. The maximum limit of deduction that can be claimed under 80 c is Rs 15 lakh per financial year.

This privilege is only for the first three years of employment. If your data is correct in Aadhaar and you would like to get your EPF UAN name updatedchanged the current procedure is a bit lengthy one. NOT available Verified demographic but if i click basic details it shows My AADHAAR number and status shows as Accepted by mumbai Field Office OK.

Changes How to file. This is the basic workings of an EPF scheme. The total EPF contribution for April will be Rs 2194.

This withdrawal is. Income Tax for FY 2019-20 or AY 2020-21. Dear sir my father was working a private concern and died two months before 82 years.

Until FY 2020-21 the interest income earned on contributions to EPF made by the. Since 2020 the default. Employees Provident Fund EPF is a retirement benefits scheme where the employee contributes 12 of his basic salary and dearness allowance.

An employee can also invest more than the basic 12 of his salary towards the EPF Fund under the provisions of the Volunteer Provident Fund.

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

How To Diversify Grow Your Epf Savings Psst Tell Your Parents About It Too No Money Lah

Epf New Basic Savings Changes 2019 Mypf My

4 Basic Saving Amount Download Table

Labour Ministry Notifies 8 65 Interest Rate On Epf For 2018 19 Interest Rates Growing Wealth Personal Finance

Pin On Club Penguin Printables

Epf Vpf Historical Interest Rate Interest Rates Rate Historical

Pin By Chin Eu On Epf Kwap Ltat Lth Pnb Ptptn Investing Periodic Table Estimate

Should You Consider Withdrawing Your Epf Savings For 2022 Black Belt Millionaire

Epf Dividend Table 2019 Dividend Life Insurance Policy Financial Instrument

How Social Security Code 2019 Will Impact Employees Gratuity Protect Their Epf Dues Savings And Investment Savings Strategy Investing For Retirement

Basic Savings Table Epf For Unit Trust Consultant 2018 Myunittrust Com

1 June 2020 The Unit Words Word Search Puzzle

Solved The Table Below Shows The Required Basic Savings In Chegg Com

Kwsp Epf Sets Rm228 000 As Minimum Target Savings At Age 55

Epf Withdrawal Education Finance Tips How To Apply